pay utah withholding tax online

You will need to use Form 941 to file federal taxes quarterly and Form 940 to report your annual FUTA tax. 4-Paying 6 of 9 4-Paying.

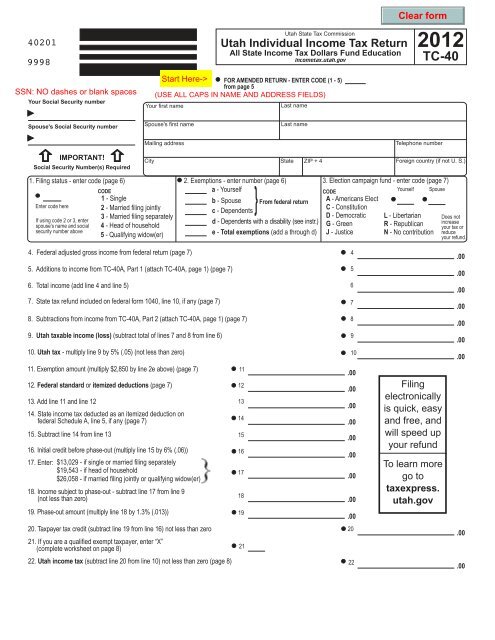

Form Tc 40 Utah State Tax Commission Utah Gov

This must be completed for OnPay to be able to file and pay your Utah taxes.

. Withholding Tax Payment Instructions. You may pay your Utah withholding tax. You may file your withholding returns online at taputahgov.

Provides free tax help. If you are required to make deposits electronically but do not wish to use the EFTPS. Use the menu for information on specific topics.

Filing Paying Your Taxes. Professional Licensing and Business Registration. 5-Year-End Reporting 7 of 9 5-Year-End Reporting.

11 Payment - single employer filing. Scroll to the Utah Tax Setup headline and select Manage taxes. You must include your FEIN and withholding account ID number on each return.

Do you need to apply for a tax account. Online payments may include a service fee. Please note that for security reasons Taxpayer Access Point is not available in most countries outside the United States.

You may use this Web site and our voice response system 18005553453 interchangeably to make payments. Rememberyou can file early then pay any amount you owe by this years due date. Sponsored by HR Block and The United Way.

You may also mail your check or money order payable to the Utah State Tax Commission with your return. See Taxpayer Access Point TAP for electronic payment options including setting up a payment agreement. It does not contain all tax laws or rules.

Utah Withholding Tax 1 of 9 active Utah Withholding Tax. How did we do. Register with the Utah State Tax Commission.

WithholdingTax Payment Instructions You may pay your Utah withholding tax. Register with the Utah State Tax Commission. Online at taputahgov through a bank debit e-check or a credit card or By sending your check or money order payable to the Utah State Tax Commission along with the coupon below to.

Your bank may request the following information in order to process an e-check debit payment request. Visit Utahgov opens in new window Services opens in new window Agencies opens in new window Search Utahgov opens in new window Skip to Main Content. After you choose to make your payment via an Electronic Funds Transfer EFT from your bank account.

See also Payment Agreement Request. You may also need. Interest is assessed on unpaid tax from the original filing due date until the tax is paid in full.

This registration is to obtain tax accounts for the Utah State Tax Commission only. You may pay your tax online with your credit card or with an electronic check ACH debit. You are about to complete the Utah State Business and Tax Registration TC-69.

Payments can be made online by e-check ACH debit at taputahgov. For tax years beginning on or after Jan. Employment Taxes and Fees.

This section discusses information regarding paying your Utah income taxes. You have been successfully. Please contact us at 801-297-2200 or taxmasterutahgov for more information.

More details about employment tax due dates can be found here. There is no fee when paying by e-check through the online system. If you pay Utah wages to Utah employees you must have a Withholding Tax license.

1-Overview 3 of 9 1-Overview. Pub 2 Utah Taxpayer Bill of Rights contains additional information regarding taxpayer rights and responsibilities. With Utahs pass-through entity withholding requirements.

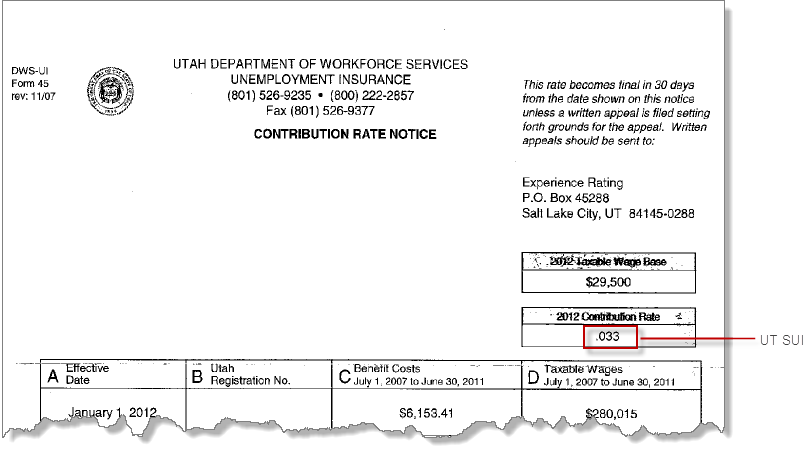

Utah State Tax Commission 210 N 1950 W SLC UT 84134-0100 Payment Coupon for Utah Withholding Tax. This must be completed for OnPay to be able to file and pay your Utah taxes. If you would like to pay your state unemployment taxes using Electronic Funds Transfer EFT during the regular online filing you will be asked to select Payment Method on Select Payment Method page by using the drop down box.

1 2009 pass-through entities must withhold Utah income tax on income from Utah sources for nonresident individual partners members and share-holders and for resident and nonresident non-individual partners. Follow the instructions at taputahgov. Just in case you want to learn even more about Utah payroll taxes here are a few helpful links.

For security reasons TAP and other e-services are not available in most countries outside the United States. Existing employers can find their Withholding Tax Account Number on Form A-1 Return of Income Withheld. This section discusses methods for filing and paying your taxes including how to file onlinethe fastest and safest way to file.

If you are required to make deposits electronically but do not wish to use the EFTPS. Unemployment Insurance administered by the Utah Department of Workforce Services. Your withholding is subject to review by the IRS.

Please contact us at 801-297-2200 or. TAP Taxpayer Access Point at taputahgov. Please note that for security reasons Taxpayer Access Point is not available in most countries outside the United States.

You can pay taxes online using the EFTPS payment system. TAP includes many free services such as tax filing and payment and the ability to manage your account online. Please contact us at 801-297-2200 or taxmasterutahgov for more information.

You may pay your tax online with your credit card or with an electronic check ACH debit. You can also pay online and avoid the hassles of mailing in a check. Utah State Tax Commission.

Utah Payroll Tax Resources. HttpstaptaxutahgovTaxExpress_ To register for a withholding account go to Apply online area Click Apply for Tax accounts TC-69 Instructions. 3-Filing 5 of 9 3-Filing.

Log into the Employee Self Serve ESS System and look for the Personal Information section select the W-4 Tax Withholding option. You can pay online with an eCheck or credit card through Taxpayer Access Point TAP. Employees must designate the number of withholding allowances they wish to claim on their paycheck.

Utah Taxpayer Access Point TAP TAP. Main Menu 2 of 9 Main Menu. Workers Compensation Coverage administered by the Utah Labor Commission.

210 N 1950 W SLC UT 84134-0100. This EFTPS tax payment service Web site supports Microsoft Internet Explorer for Windows Google Chrome for Windows and Mozilla Firefox for Windows. You may also pay with an electronic funds transfer by ACH credit.

It does not contain all tax laws or rules. Withholding Tax Account Number. 6-Penalties Interest 8 of 9 6-Penalties Interest.

The Utah State Tax Commissions free online filing and payment system. You must include your FEIN and withholding account ID number on each return. 2-General Information 4 of 9 2-General Information.

To update increase or change the number of exemptions you have two options. You may prepay through withholding W-2 TC-675R 1099-R etc payments applied from previous year refunds credits and credit carryovers or payments made by the tax due date using form TC-546 Individual Income Tax Prepayment Coupon or at taputahgov. Utahs Taxpayer Access Point.

What Is A Mortgage Loan Mortgage Loans Mortgage Home Mortgage

Utah State Tax Benefits Information

Income Tax Of India Income Tax Online Education One Liner

Kiplinger Tax Map Retirement Tax Income Tax

New Jersey Income Tax Calculator Smartasset Income Tax Income Tax Return Federal Income Tax

Utah State Tax Commission Official Website

Utah Sales Tax Small Business Guide Truic

Utah Tax Forms And Instructions For 2021 Form Tc 40

2021 Contribution Limits Increase For Utah Income Tax Credit Or Deduction

Median Household Income And Taxes State Tax Levels In The United States Wikipedia Ricevimenti Valutazione

Utah State Tax Benefits Information

Income Tax Law Tax Lawyer Tax Attorney Family Law Attorney

Which Is Best Health Insurance Policy For Income Tax Saving In India Cheap Car Insurance Quotes Compare Quotes Insurance Quotes